Budgeting

Debt Consolidation vs. Settlement: Which 2026 Strategy Saves More?

Consolidation saves your credit; settlement saves your cash. Compare 2026 tax implications, credit score impacts, and hidden fees before choosing.

Loans

Gig Workers: Personal Loans or Income-Based Hardship Plans?

Freelancer debt guide: Decide between personal loans for optimization or hardship plans for survival. Learn how to prove income volatility...

Medical Payment Plans vs. Loans: Preserving Your Cash Flow

Don't rush to pay medical bills with a credit card. Learn why provider payment plans are often superior to loans...

Debt

Credit

Floating vs. Fixed: Timing Your Consolidation During 2026 Rate Volatility

Should you choose a fixed or floating rate for debt consolidation in 2026? We analyze the risks of HELOCs vs. personal loans in a volatile rate environment.

Financial Infidelity: Managing Secret Debt in Shared Finances

Hiding debt hurts more than your wallet-it breaks trust. Learn how to manage financial infidelity, choose the right debt relief, and rebuild transparency.

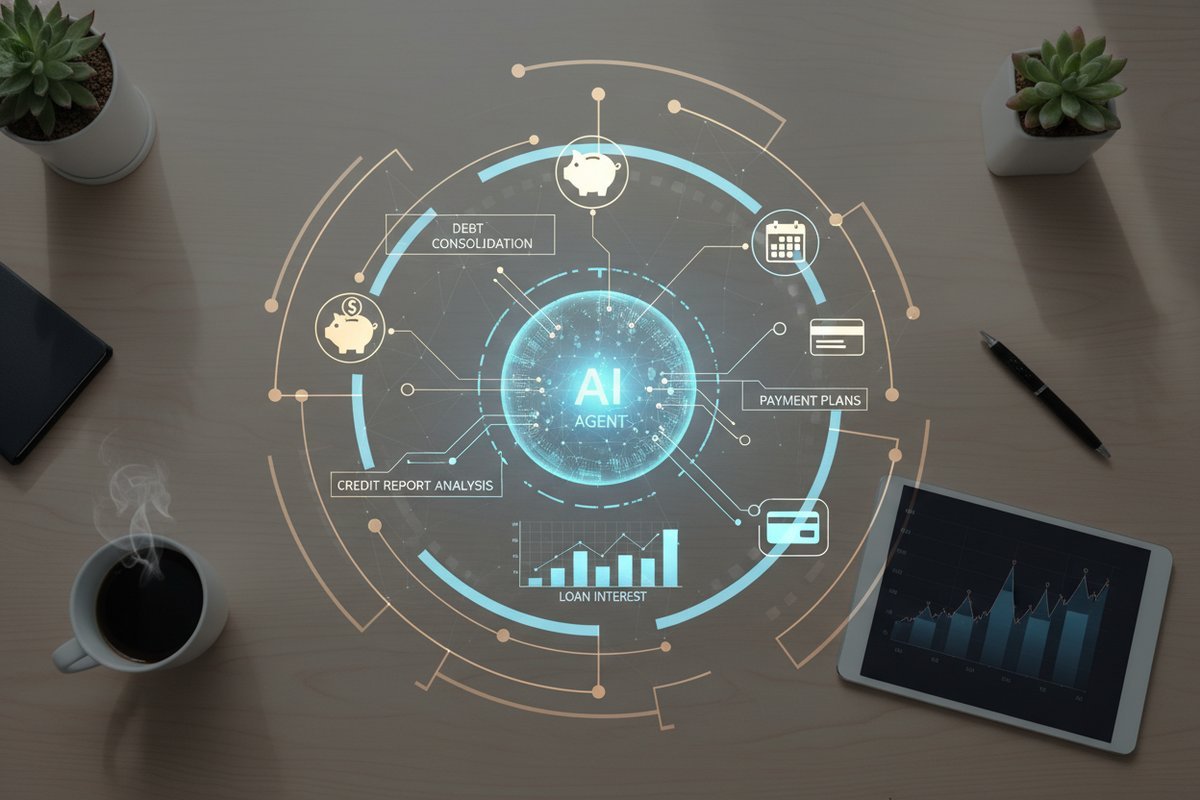

Consumer AI Agents: Automating Your Debt Negotiation Strategy

Should you let an AI negotiate your debt? Discover the difference between AI Coaches and Agents, and avoid the common mistake that restarts your debt clock.

Sandwich Generation: Balancing Elder Care Costs With Debt Repayment

Caught between student loans and elder care costs? Stop raiding your retirement. Here is a decision guide on tax breaks, asset use, and debt triage for the sandwich generation.

Wellness

Adult Children at Home: Charging Rent vs. Shared Debt Repayment

Should you charge adult children rent or make them pay off debt? Explore the Lender vs. Landlord models to build their financial independence.